Ant Money Migrates from PostgreSQL to SingleStore on AWS, Boosting Performance 20-100x and Reducing TCO by 90%

Improvement in data freshness and performance

60x

Increase in actionable data

50x

Ant Money reduced TCO by 90%

90%

Increase in engagement for Ant Money’s partner apps

Up to 11x

Increase in customer lifetime value (CLV) for Ant Money’s partner apps

Up to 4x

Investing has come a long way from the days when you would get on a phone call, pay someone a few dollars, and ask them to buy a stock for you. Apps are democratizing access to investments, but those who are not tech-savvy are left behind, and even those who are comfortable accessing apps are left largely on their own once in the app. As a result, just over half of Americans participate in the stock market.

Ant Money is opening access to the world's capital markets to current and prospective investors by bringing investments to the sites and apps they already use. It created an embedded finance solution—a solution that enables non-financial services companies to offer customers access to credit through their technology platform—and thus positioned itself to play a key role in an emerging market that’s expected to reach $834 billion by 2034. Customers can be individuals or businesses, and the credit can be offered by the company or by a third party. Those third parties are important, and Ant Money has a growing roster of partners all serving customers in the Ant Money mobile app.

Ant Money strongly believes in bringing more people over to the other side of investment. Its goal is a very simplified interface with the least amount of friction to get individual users set up for an investment account. The company workswith different third-party apps to see if they can put in some micro income or seed the user’s investment account. This goes a long way in actually getting people to realize the benefit of investing, and brings a very valuable user to the customer app who is engaged with the investment platform.

Challenges/Goals

The success of Ant Money’s embedded finance solution has resulted in aggressive growth including 3x user growth, 5x increase in revenue, 1,200+ sponsors and partners, and $20+ million in series A funding. However, this growth has led to technical challenges.

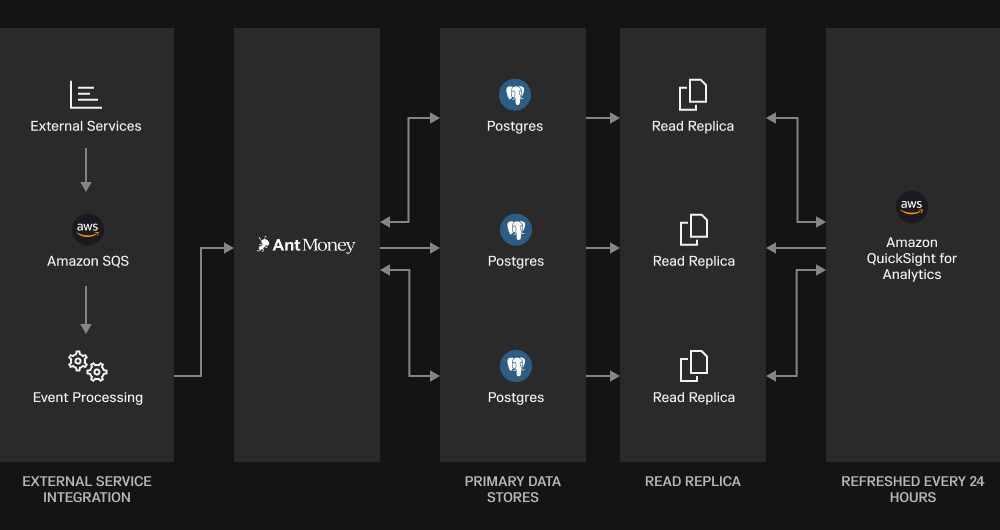

Ant Money launched its platform with PostgreSQL for first-party data and another system for analytics, as it was easy to prototype, ingest data, and perform basic reports with this configuration. However, this was a costly, fragile system not well-suited for the long term.

The existing system was not only costly, it also required giant PostgreSQL replica sets. Ant Money felt it was not the best choice to transform and process data, and ingesting data from different sources was tricky. It was more of a reporting platform rather than the real-time ingestion system it needed.

The system was slow, with queries taking seconds to minutes to process, and lacked coverage for emergent data sources such as ATM.com or financial services. The replicated data needed to be re-ingested, and the dashboard only refreshed once every 24 hours, leading to a serious and unacceptable lag in data freshness.

Most apps using Ant Money didn’t store a lot of information due to performance constraints on writes to PostgreSQL, and data from other partners was nearly impossible to obtain so Ant Money could enrich its first-party data. Ant Money had to do a bulk load of the data and it was so time-consuming that certain data was skipped. Ant Money was dropping approximately 2.4GB per day of data due to these issues.

Ant Money’s architecture before SingleStore

Ant Money believes everyone should be able to slice and dice data in the company. If someone needed data before, they had to talk to someone in engineering or the data team. We have a variety of internal users who are fairly savvy with looking up data, but they were blocked and unable to get additional insight or feedback in terms of how to shape some of our data,” said Singh. While Ant Money could solve this problem with PostgreSQL, it was cost-prohibitive to do so, as it would need to supersize its Postgres instances to scale the system.

Ant Money needed a way to improve performance, lower TCO, achieve cost-effective scaling, and empower its teams with real-time analytics.

Technology Requirements

Ant Money needed to connect all of its embedded installs and microservices, each with its own data, into a single, unified data store. Its technology requirements included:

- A performance analytics engine with columnstore to democratize data access across the organization.

- Near real-time analytics with very fast reads and quick ingestion. Ant Money wanted the data to be available as soon as possible to make data-driven decisions faster.

- Support for unstructured data types, including clickstream data within apps that have been embedded inthe Ant Money SDK.

- Scalability to support Ant Money’s accelerated growth trajectory.

- A managed service, so it could focus on its platform rather than its data store.

- A data warehouse that could scale for reads and other workloads including UPSERTs.

- Ingesting data from external partners such as mobile marketing partners.

- The ability to manage non-read workloads such as data and column compression.

Why SingleStore

Being a small startup with a lean engineering team, Ant Money did not want to spend time working on the ins and outs of scaling databases, doing sharding, and figuring out what partitioning would look like, then embedding some of that logic in its backend. For this reason, it went with the managed service, as it allows teams to focus on what they are really there to do.

The company never got to the breaking point with its previous solution, but saw plenty of warning signs. Queries were running, but getting slow; the database instance was getting bigger and bigger; and cost was escalating. They realized it was a good time to have a data warehouse and started looking for a partner. They did a cost and performance analysis and chose SingleStore.

This powerful modern database offers ultimate data ingestion performance at scale, supporting built-in batch loading and real-time data pipelines. It integrates with many streaming ingest feeds, including Apache Kafka, Amazon S3, Azure Blob, and Hadoop Distributed File System (HDFS), with no additional middleware required.

Solution

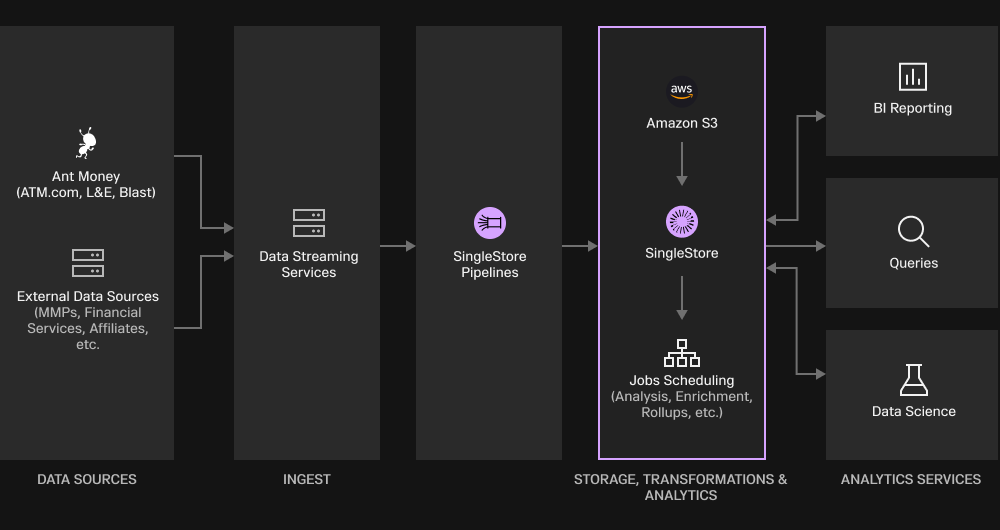

Once Ant Money selected SingleStore Helios Cloud, it updated its platform’s architecture to determine what to change in its data pipelines. Ant Money is using SingleStore as its core data platform for transactions (OLTP) and overall data management. With SingleStore, it was able to standardize its ingestion path to data streaming services to support external sources it couldn’t ingest before. Clickstream data, financial services data, data from affiliate networks, and its own applications are now coming in.

The applications log into Amazon Kinesis, which streams into Amazon S3 using a delivery stream. SingleStore offers a primitive called pipelines, making it easy to tap into different data sources. SingleStore ingest data in less than a minute, whereas it formerly pushed the PostgreSQL data into Amazon S3 for an UPSERT workload. It can be an S3 bucket, Kafka, Azure, or Google storage buckets. SingleStore handles this for Ant Money internally. All the team must do is write the commands, point it to where the data needs to go, and specify how the data needs to be shaped as it's ingested into SingleStore.

Ant Money has an occasional need to re-ingest data. By using Amazon S3, which is low-cost and offers long-term archival storage, it can always replay the data without overly burdensome expenses. It can get a better picture of the business by replaying the event stream from one point in time to another.

Ant Money’s Architecture with SingleStore

Ant Money also moved to Metabase and Tableau for its long-term analytics solution after adopting SingleStore. These tools plug in directly into SingleStore, making it easy for teams to slice and dice data and thus making the democratization of analytics simpler and less costly.

Outcomes

Ant Money has generated significant business and technology gains by investing in SingleStore:

60X Improvement in Data Freshness and Performance

Ant Money now has a system that is truly data-driven and offers the freshest available data for all, with insights in real time instead of an hour. Product, marketing, and other teams all consume this data daily.

50X Increase in Actionable Data

Ant Money is now ingesting and processing 50x more actionable data. The teams are able to have self-service because users outside the engineering team now have access to the data warehouse. Business users can run ad hoc queries as needed, and the team can shape the data in the way it wants to slice and dice it, making it a lot more usable. Reporting is much better as well, and Ant Money is now properly set up to ingest additional types of workloads and unlock other capabilities such as AB testing and data science work.

90% Reduction in TCO

Ant Money has reduced TCO 90% by moving to SingleStore Helios. It now has a future-proof system with workload and tooling scalability. In addition to lowering Ant Money’s direct data warehouse costs, SingleStore also delivered several indirect benefits.

Because of SingleStore’s separation of storage and compute, Ant Money is also achieving substantial savings on the scaling front as well.

Up to 11x Higher Engagement and up to 4x Higher CLV for App Partners

The many partners embedding Ant Money’s investment products are also reaping significant value from SingleStore, as a number of their own apps have seen an 11x increase in engagement and a 4x increase in customer lifetime value (CLV).

SingleStore is helping companies compete and win across all verticals. Learn more →